- 74 -

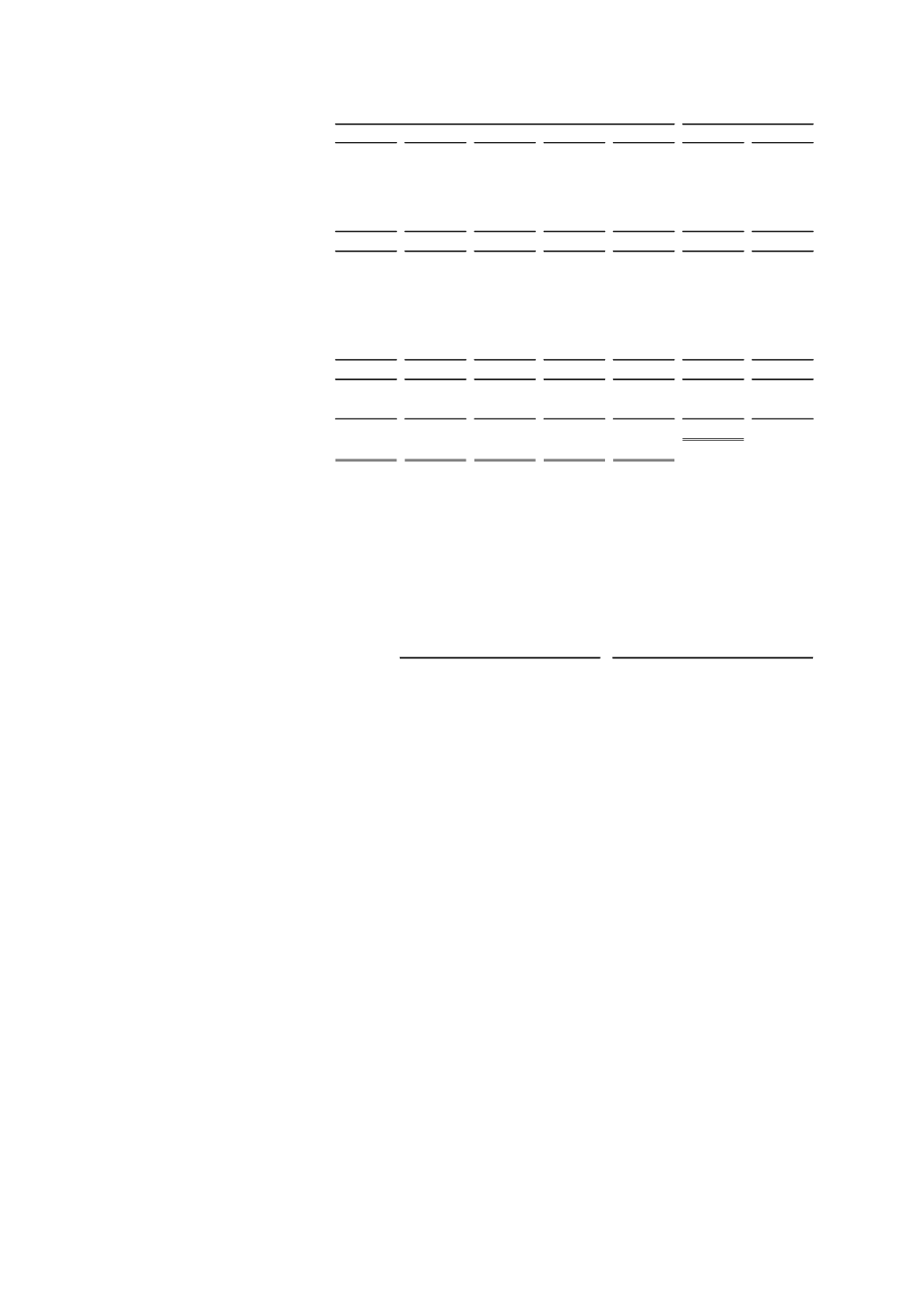

Up to 1 month

From 1 to 3

months

From 3 to 12

months

From 1 to 5

years

More than 5

years

Do not accrue

interests

Total

S/. 000

S/. 000

S/. 000

S/. 000

S/. 000

S/. 000

S/. 000

Assets

Cash

527,872

-

-

-

-

(4,190)

523,682

Available for sale investments

3,089

319,557

24,874

202,343

970,766

2,369,604

3,890,233

Loan portfolio, net

131,467

572,270

814,026

2,055,774

2,073,588

(452,378)

5,194,747

Hedging derivatives

2

4

15

80

39

(140)

-

Accounts receivable, net

-

-

-

-

-

56,409

56,409

Other assets

-

-

-

-

-

49,773

49,773

Total assets

662,430

891,831

838,915

2,258,197

3,044,393

2,019,078

9,714,844

Liabilities

Obligations to the public

4,847

1,767

40,943

-

-

-

47,557

Deposits by Banks and

financial organizations

-

10,183

185,286

-

-

-

195,469

Debts with financial entities

233,382

353,967

501,926

1,326,482

419,474

-

2,835,231

Financial obligations

52,005

27,973

49,565

957,748

2,823,204

-

3,910,495

Hedging derivatives

1,854

3,708

16,682

88,971

44,484

-

155,699

Accounts payable

-

-

-

-

-

9,423

9,423

Other liabilities

-

-

-

-

-

306,536

306,536

Equity

-

-

-

-

-

2,254,434

2,254,434

Total liabilites and equity

292,088

397,598

794,402

2,373,201

3,287,162

2,570,393

9,714,844

Off-balance sheet account:

Assets hedging derivatives

-

19,170

16,350

165,135

395,388

-

596,043

Liabilities hedging derivatives

-

24,458

20,859

210,682

504,440

-

760,439

Marginal gap

370,342

488,945

40,004

(160,551)

(351,821)

(551,315)

Accumulated gap

370,342

859,287

899,291

738,740

386,919

2014

Sensitivity to changes in interest rates

Exposure to interest rates is supervised by the Assets and Liabilities Committee, as well as

by the Risk Committee. The latter approves maximum allowed limits.

Presented below, sensitivity on indications of interest rate towards a 200 basis points

shock, is detailed below:

GER =

S/.24,045,627 (0.691% p.e)

S/.49,077,301.38 (1.7357% p.e)

VPR =

S/. 143,377,616 (4.122% p.e)

S/.54,354,634.53 (1.9223% p.e)

2014

2015

It is important to remark that this information flows from the internal interest rate model of

COFIDE, updated in December 2015.

(ii)

Foreign currency exchange risk

Exchange rate risk in foreign currency is related with the variation of value of positions of

the statement of financial position and off such statement that are negatively affected by

changes in exchange rate. This risk depends on the position on each currency and of the

volatility of exchange rates. A significant portion of assets and liabilities is in U.S. dollars.

Management sets limits in exposure levels per currency, which are monitored monthly.

Most of assets and liabilities in foreign currency are held in U.S. dollars.

Foreign currency transactions are made at free market exchange rates.

As of December 31, 2015, weighted average exchange rate of the free market, published

by the SBS for transactions in U.S. dollars was of S/.3.408 per US$1 for purchase and

S/.3.413 per US$1 for sale (S/.2.981 and S/.2.989 as of December 31, 2014, respectively).

As of December 31, 2015, the exchange rate for accounting asset and liability accounts in

foreign currency fixed by the SBS was the average rate of purchases and sales, equivalent

to S/.3.411 per US$1 (S/.2.986 as of December 31, 2014).