- 80 -

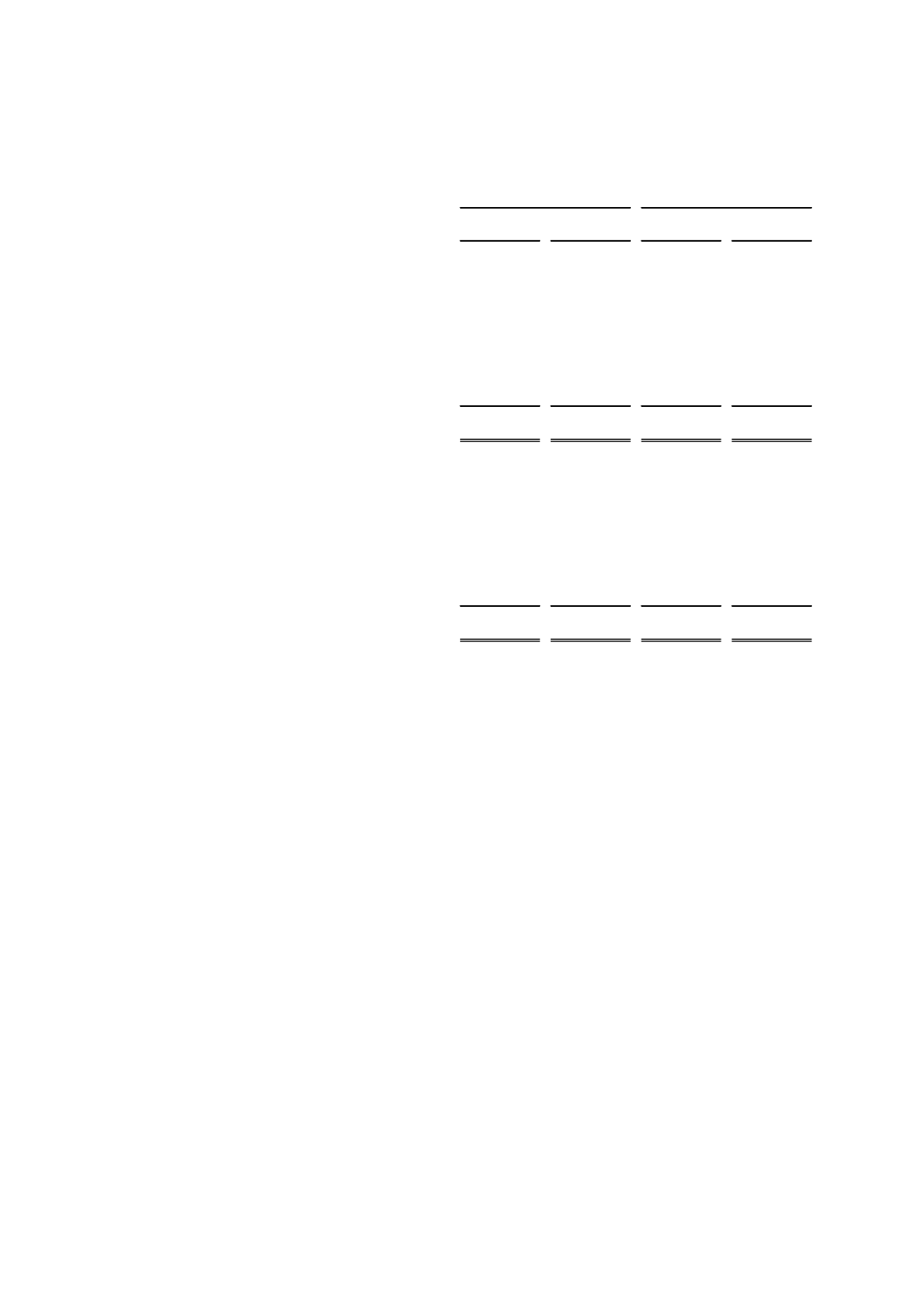

A comparison between the carrying amounts and fair values of financial instruments of

COFIDE, according to the methodology explained above, presented in the statements of

financial position, is detailed as follows:

Carrying

Fair

Carrying

Fair

Fair value and carrying amount

amount

value

amount

value

Asset

Cash

1,956,711

1,956,711

523,682

523,682

Available for sale investments:

Capital instruments

2,586,935

2,586,935

2,676,964

2,676,964

Debt instruments

1,555,932

1,555,932

1,213,269

1,213,269

Loan portfolio, net

7,309,996

7,309,996

5,194,747

5,194,747

Hedging derivatives

3,657

3,657

-

-

Accounts receivable, net

73,435

73,435

56,409

56,409

Other assets

1,264

1,264

623

623

Total

13,487,930

13,487,930

9,665,694

9,665,694

Liability

Obligations to the public

32,564

32,564

47,557

47,557

Deposits by Banks and

financial organizations

224,944

224,944

195,469

195,469

Due to banks

2,888,054

2,886,867

2,835,231

2,835,576

Financial obligations

7,291,067

7,316,673

3,910,495

3,910,336

Hedging derivatives

149,748

149,748

155,699

155,699

Accounts payable

12,356

12,356

9,423

9,423

Other liabilities

42,904

42,904

42,570

42,570

Total

10,641,637

10,666,056

7,196,444

7,196,630

2015

2014

Assets granted as guarantee:

As of December 31, 2015, COFIDE has carried out repo transactions comprising resources

in local currency for (in thousands) S/.21,051, granted from several trusts managed by

COFIDE, which accrue interests at a certain annual rate and are guaranteed by Structured

Bonds, whose carrying amount is (in thousands) S/.24,246 and face value is (in thousands)

US$6,978. As of December 31, 2014, COFIDE has carried out repo transactions

comprising resources in local currency for (in thousands) S/.28,861, granted from several

trusts managed by COFIDE, which accrued interests at a certain annual rate and were

guaranteed by Structured Bonds, whose carrying amount was (in thousands) S/.30,448 and

face value was (in thousands) US$10,643, as of December 31, 2014.

Granted funds are intended to assist different obligations of COFIDE.

22.

MANAGEMENT OF OTHER RISKS

(a)

Operational risk

Operational risk is generated by human, processes, systems errors or by external factors,

including legal risk.

COFIDE has identified its operational risks focusing on transversal processes comprised in its

cooperativeness. Additionally, continuous improvements are made in policies and

methodologies of identification, assessment and follow-up of operational risk, as well as the

definition of roles and responsibilities of those charged with its management.