- 79 -

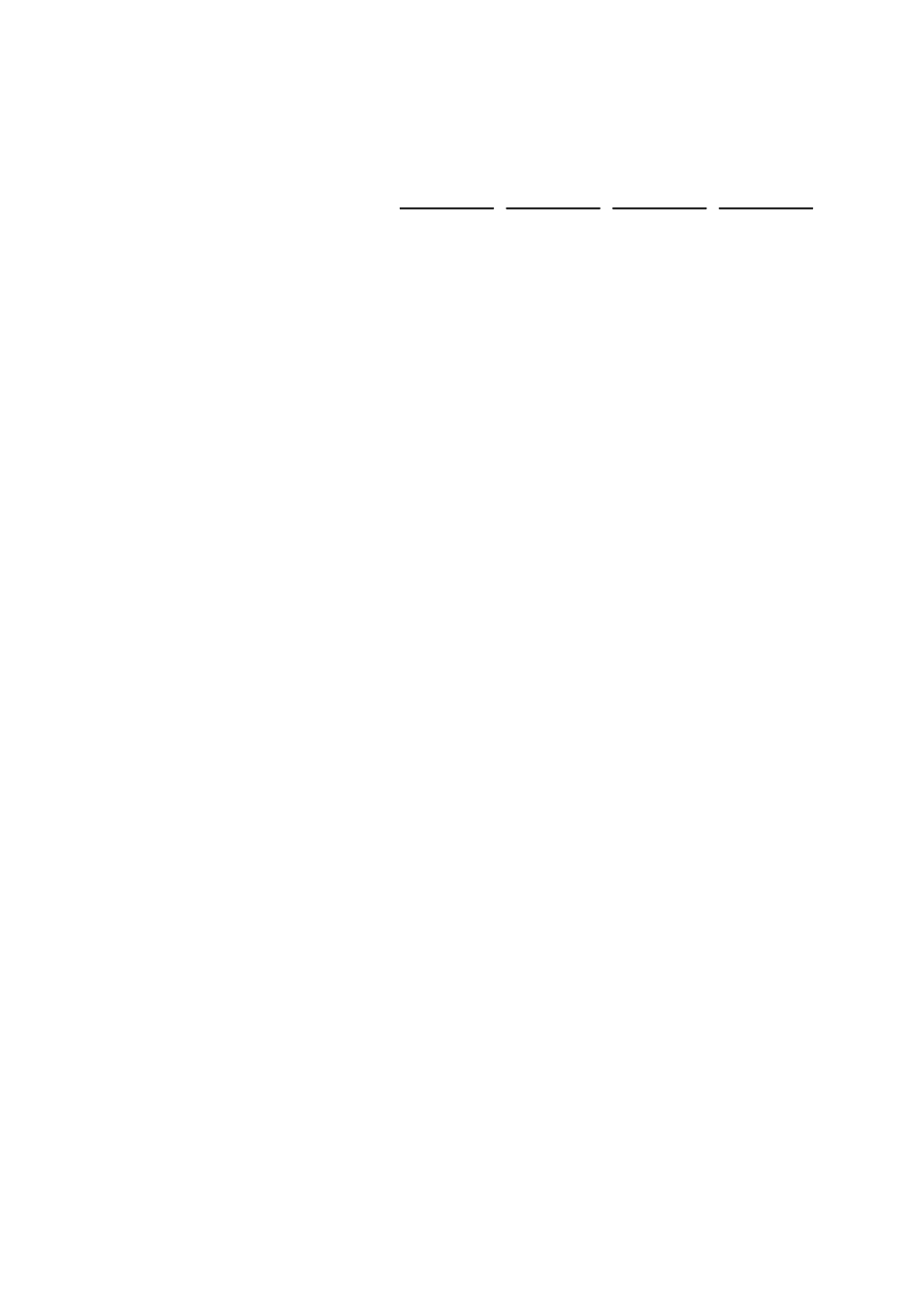

As of December 31, 2015 and 2014, period when cash flows of the hedge are expected to

occur, the effect in the statement of income, net of deferred income tax is as follows:

Up to 1 year

From 1 to 3

years

From 3 to 5

years

Over 5 years

S/.000

S/.000

S/.000

S/.000

Cash outflow

(liability) 2015

21,393

42,785

42,785

44,485

Cash outflow

(liability) 2014

22,244

44,485

44,485

44,485

In January 2015, fifteen currency swaps and one interest-rate swap were early settled, and

as a result, unrealized loss of accumulated cash flow hedges were transferred to the

statement of income that date for (in thousands) S/.7,070. Therefore, during 2015 and

2014, accumulated balance of cash flow hedges, presented as other comprehensive income

in profit/loss for effective hedges, is being realized within the term of the underlying

financial instrument (unrealized profit/loss, net of deferred income tax, was (in thousands)

a net unrealized profit for S/.5,588 and net unrealized loss for S/.12,489, respectively; see

cash flow hedges in the statement of changes in equity).

As of December 31, 2015 and 2014, COFIDE holds 4 and 19 currency swaps,

respectively, according to the SBS authorizations, which classify as cash flow hedges of

debts. By means of such operation, in economic terms, the debt held by COFIDE is

hedged.

Additionally, as of December 31, 2015 and 2014, COFIDE holds one interest-rate swap in

order to hedge the variable rate component of certain debts, which mature in 2019.

COFIDE has a methodology of measurement of the degree of ineffectiveness of hedges of

derivative financial instruments that are undertaken with such objective. As of December

31, 2015 and 2014, COFIDE has not presented a decrease in relation to ineffectiveness of

these hedges in the statement of income.

(ii)

Instruments whose fair value is similar to carrying amount.- For financial assets and

liabilities that are short-term, among which cash, inter-bank funds and other similar

are classified.

(iii)

Financial instruments at fixed rates

Financial asset at fixed rates (loans portfolio, obligations with the public and deposits of

financial entities) – According to SBS Multiple Official Letter 1575-2014, fair value of

these items correspond to their carrying amount.

Financial liabilities at fixed rates – These liability instruments may be quoted or not in

active markets. For bonds issued by COFIDE and quoted in active markets, fair value

corresponds to quote market value.

For liabilities that are not traded in an active market (debts granted and bonds issued by

COFIDE) fair value is calculated based on discounted value of future flows using original

effective interest rate.