- 71 -

Additionally, COFIDE assesses liquidity in the medium and long-term through a structural

analysis of its inflows and outflows of funds in various maturity terms, using as modeling

tools of the static cash flow, dynamic and estimate of liquidity gaps between asset and

liability positions in and off the statement of financial position over a determined term

horizon. This process allows knowing various funding sources, how liquidity needs grow

and what tenors are mismatched. Assets as well as liabilities are considered internal

assumptions for obligations estimated as a result of contingent liabilities, as may also be

guarantee letters or unutilized credit lines. Acknowledging this information, necessary

decisions are made to maintain objective liquidity levels.

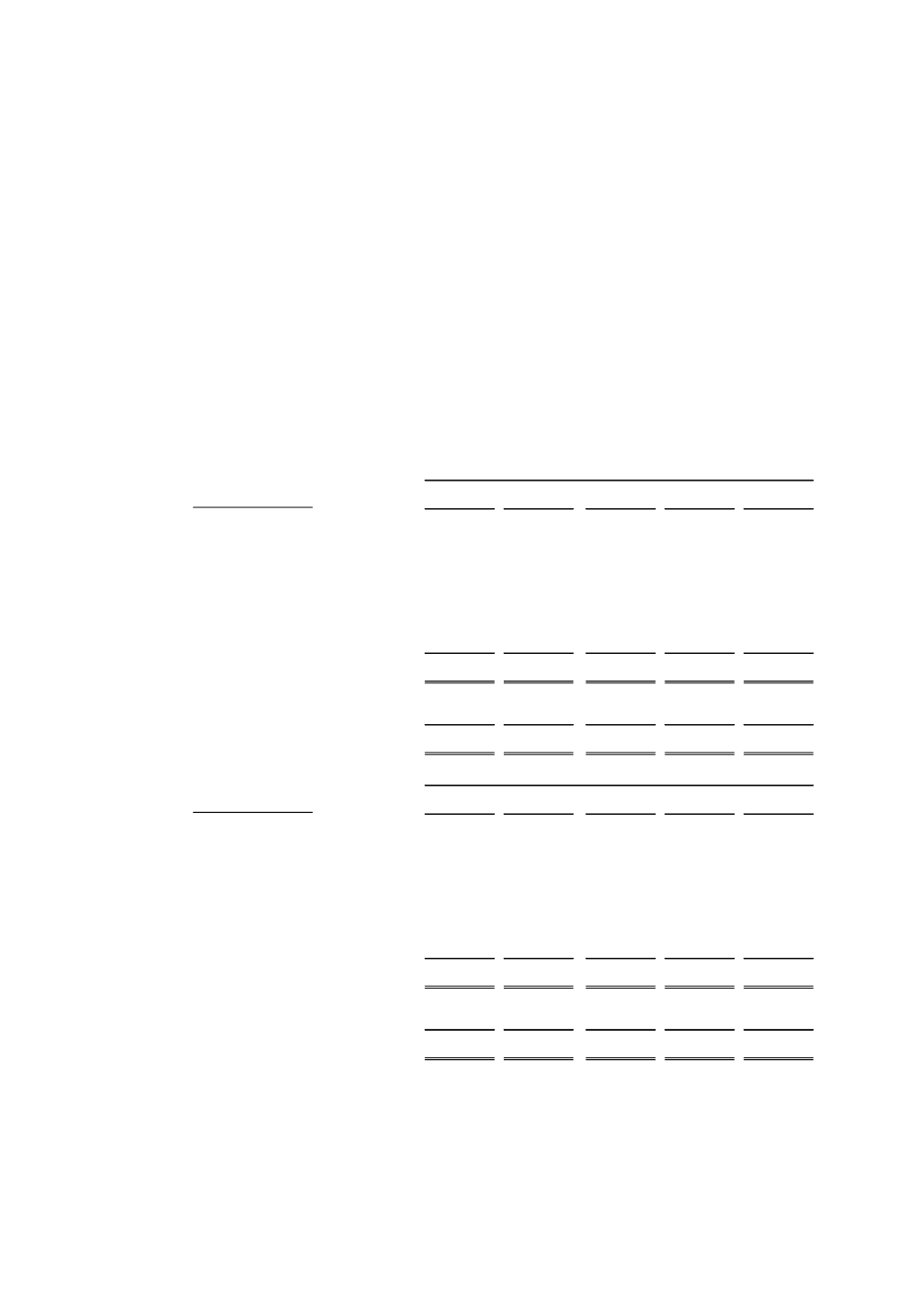

The table below presents cash flows payable by COFIDE according to agreed contractual

terms. In the case of liabilities with undetermined maturity, terms are assumed according

to internal assumptions, based on methodological notes from Attachment 16 – Liquidity

for maturity term (table).

Amounts disclosed are cash flows according to terms contracted without discounts and

include their corresponding accrued interests.

Up to

Over 1 up to Over 3 up to

Over

Exposure to liquidity risk

1 month

3 months

12 months

1 year

Total

S/.000

S/.000

S/.000

S/.000

S/.000

Risk of financial position

Liability

Obligations with the public

-

21,051

11,513

-

32,564

Deposits in financial entities and

international financial organizations

37,246

36,169

151,529

-

224,944

Debts and financial obligations

322,776

271,567

1,641,128

7,943,650

10,179,121

Hedging derivatives

1,783

3,566

16,044

128,355

149,748

Accounts payable

4,800

6,096

335

-

11,231

Other liabilities

633

-

492

-

1,125

Total

367,238

338,449

1,821,041

8,072,005

10,598,733

Risk of financial position

Contingent liabilities

-

-

-

553,892

553,892

Total

367,238

338,449

1,821,041

8,625,897

11,152,625

Up to

Over 1 up to Over 3 up to

Over

Exposure to liquidity risk

1 month

3 months

12 months

1 year

Total

S/.000

S/.000

S/.000

S/.000

S/.000

Risk of financial position

Liability

Obligations with the public

4,847

1,767

40,943

-

47,557

Deposits in financial entities and

international financial organizations

-

10,183

185,286

-

195,469

Debts and financial obligations

285,387

381,940

551,491

5,526,908

6,745,726

Hedging derivatives

1,854

3,708

16,682

133,455

155,699

Accounts payable

3,374

5,068

-

-

8,442

Other liabilities

652

-

463

-

1,115

Total

296,114

402,666

794,865

5,660,363

7,154,008

Risk of financial position

Contingent liabilities

-

21,948

18,719

641,745

682,412

Total

296,114

424,614

813,584

6,302,108

7,836,420

2014

2015

Market risk

Market risk is the possibility of losses for variations in conditions of the financial market.

Main variations may be in: i) interest rates, ii) exchange rates, and iii) prices.