- 73 -

The results of these two internal interest risk indicators in a normal scenario are as

follows:

GER =

S/.23,558,205 (0.677% p.e)

S/.29,314,290.50 (1.0367% p.e)

VPR =

S/.140,661,988 (4.044% p.e)

S/.64,557,323.06 (2.2832% p.e)

2015

2014

Following-up of interest rate risk is informed to the Risk Committee as well as to the

ALCO Committee. The Risk Committee approves sundry limits considered to manage and

following-up is in charge of the Risks division.

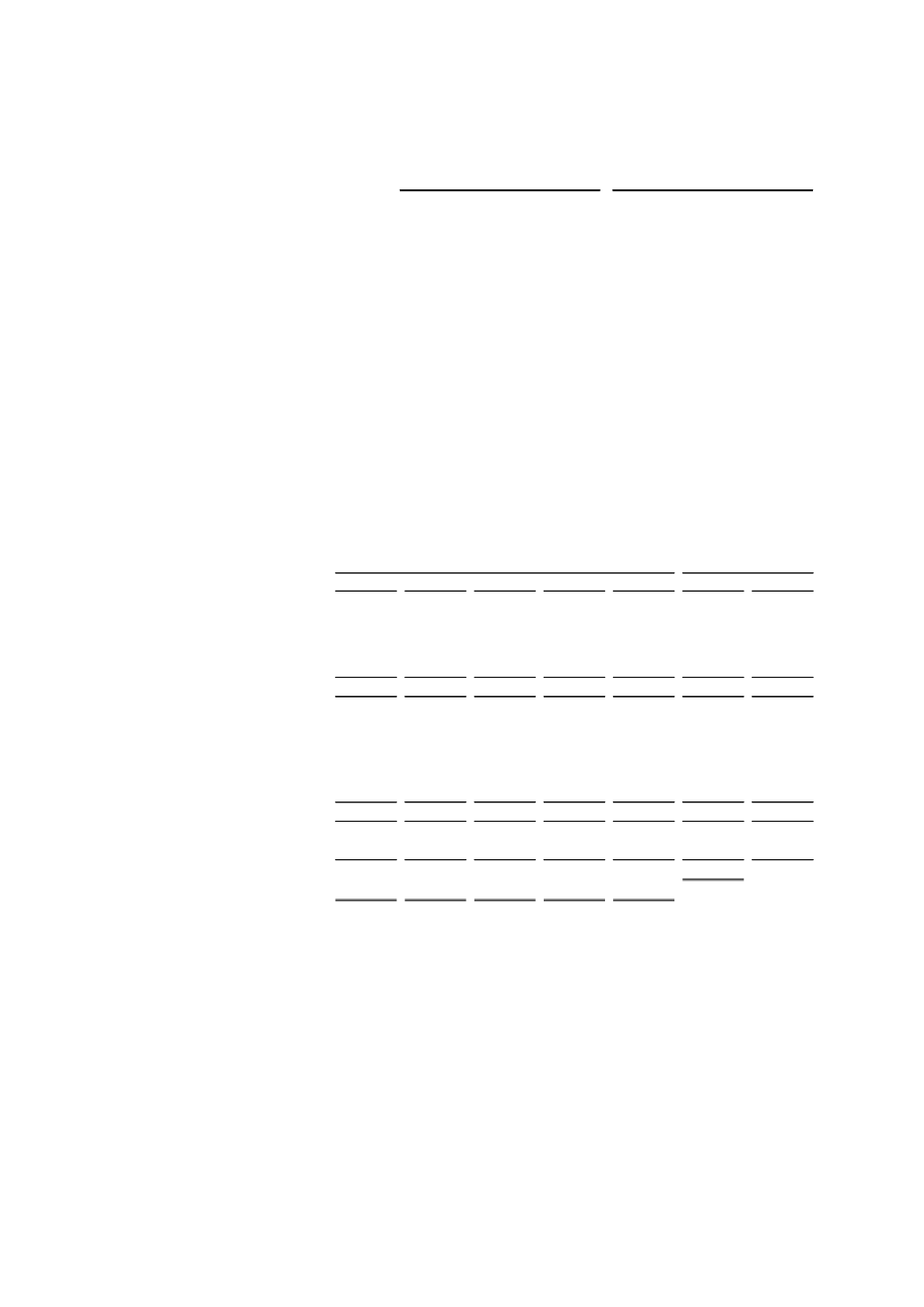

Re-pricing gap

An analysis of re-pricing gap is made in order on determine the impact of changes in

interest rates. The analysis consists in assigning in different gaps of time balances of

operations that should change interest rates. Based on this analysis, impact for each gap of

the interest rate variation is calculated.

The table below summarizes exposure of COFIDE on interest rate risks. Financial

instruments of COFIDE are presented at their carrying amounts, classified between the re-

pricing period of the interest rate of the agreement or maturity date, whichever occurs first.

Up to 1 month

From 1 to 3

months

From 3 to 12

months

From 1 to 5

years

More than 5

years

Do not accrue

interests

Total

S/. 000

S/. 000

S/. 000

S/. 000

S/. 000

S/. 000

S/. 000

Assets

Cash

1,995,045

-

-

-

-

(38,334)

1,956,711

Available for sale investments

-

211,252

42,444

245,864

1,286,829

2,356,478

4,142,867

Loan portfolio, net

730,565

1,217,195

1,304,614

2,380,198

2,264,079

(586,655)

7,309,996

Hedging derivatives

46

92

409

2,180

1,088

(158)

3,657

Accounts receivable, net

-

-

-

-

-

73,435

73,435

Other assets

-

-

-

-

-

58,564

58,564

Total assets

2,725,656

1,428,539

1,347,467

2,628,242

3,551,996

1,863,330

13,545,230

Liabilities

Obligations to the public

-

21,051

11,513

-

-

-

32,564

Deposits by Banks and

financial organizations

37,246

36,169

151,529

-

-

-

224,944

Debts with financial entities

119,022

239,613

1,551,908

520,477

457,034

-

2,888,054

Financial obligations

203,754

31,954

89,220

1,779,586

5,186,553

-

7,291,067

Hedging derivatives

1,783

3,566

16,044

85,570

42,785

-

149,748

Accounts payable

-

-

-

-

-

12,356

12,356

Other liabilities

-

-

-

-

-

245,679

245,679

Equity

-

-

-

-

-

2,700,818

2,700,818

Total liabilities and equity

361,805

332,353

1,820,214

2,385,633

5,686,372

2,958,853

13,545,230

Off-balance sheet account:

Assets hedging derivatives

-

-

-

35,782

349,113

-

384,895

Liabilities hedging derivatives

-

-

-

51,493

502,399

-

553,892

Marginal gap

2,363,851

1,096,186

(472,747)

226,898

(2,287,662)

(1,095,523)

Accumulated gap

2,363,851

3,460,037

2,987,290

3,214,188

926,526

2015