- 26 -

7.

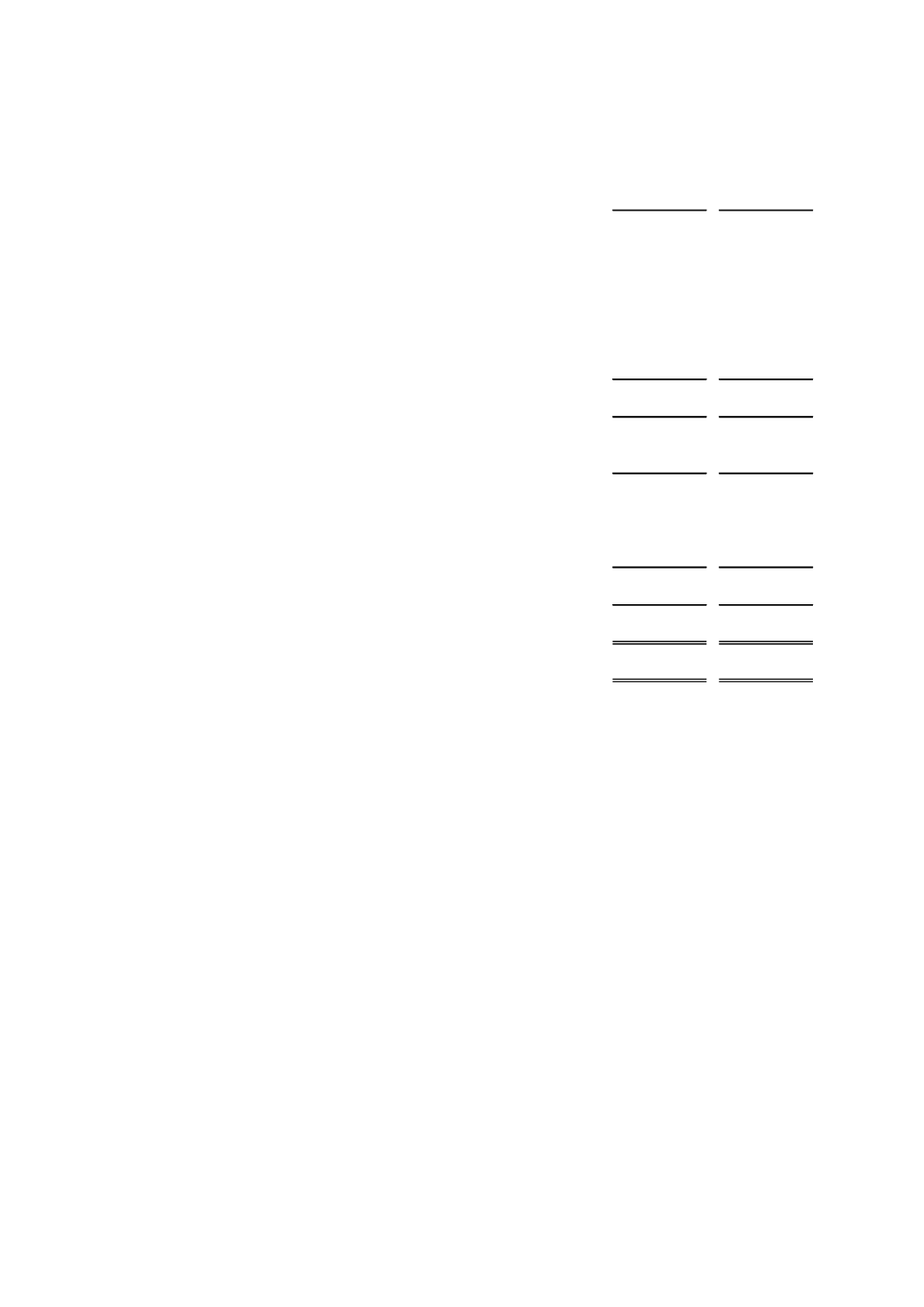

LOAN PORTFOLIO, NET

(a)

Loan portfolio comprises the following:

2015

2014

S/.000

S/.000

Direct loans:

Loans to intermediary financial institutions

7,405,143

5,390,624

First-tier loans

164,582

13,201

Restructured loans

14,270

12,492

Refinanced loans

2,267

5,066

Past-due loans

57,742

144,058

Accounts under legal collection

257

1,219

Total direct loans

7,644,261

5,566,660

Plus:

Accrued interests on loans

310,390

225,742

Less:

Provision for impaired loans

(640,946)

(594,442)

Deferred interests

(3,709)

(3,213)

(644,655)

(597,655)

Total

7,309,996

5,194,747

Contingent loans (note 14)

773,390

658,468

The balance of the loan portfolio, comprised of direct and contingent loans, mainly

corresponds to loans in foreign currency granted to Intermediary Financial Institutions

(IFIs) and first-tier portfolio.

Loans granted to IFIs are guaranteed through contractual clauses comprised in global

contracts of resources channeling subscribed with each debtor, where COFIDE is entitled to:

i) the automatic collection of debt installments through a charge on the checking account that

the debtor holds in BCRP and/or operating Bank he designates and ii), by transferring rights

over loan portfolio financed with COFIDE’s resources up to the amount of the debt, including

interests, commissions, arrears and other expenses. This transfer becomes effective if a bank

fails to comply with the payment of one installment or when COFIDE believes there are

special circumstances that complicate the recovery of resources granted. For other IFIs,

coverage is similar, except if designated to an operator bank other than the BCRP.