- 22 -

As of December 31, 2014, COFIDE granted Structured Bonds of Terminales Portuarios Paita as

guarantee for (in thousands) S/.30,448 in order to secure two repurchase agreements with Trusts

“Credito Beca” and one operation with “FISE 1”, which matured in January, March and June

2015, respectively.

Also, as of December 31, 2014, COFIDE has guarantee funds for Margin Call in order to secure

operations with interest-rate and currency derivatives held by COFIDE in favor of J. Aron &

Company for (in thousands) US$16,590.

5.

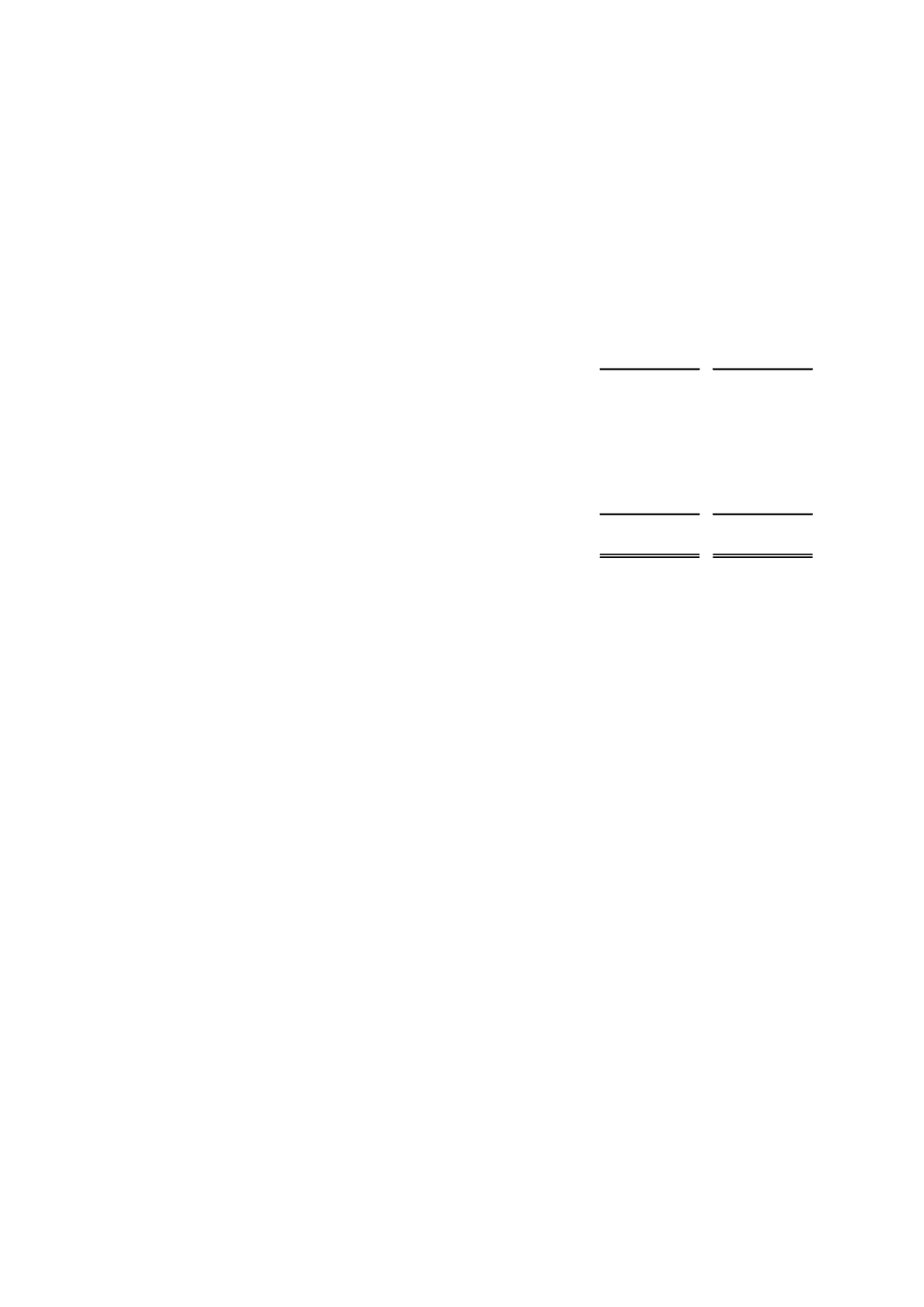

CASH

2015

2014

S/.000

S/.000

Banco Central de Reserva del Perú - BCRP (a)

76,923

155,298

Checking accounts

1,912,123

372,235

Accrued interests from cash

5,936

275

Other deposits

64

64

Provision for country risks (b)

(38,335)

(4,190)

Total

1,956,711

523,682

(a)

As of December 31, 2015, in BCRP, balances include (in thousands) US$1,640 and

S/.11,636 ((in thousands) US$888 and S/.3,246 as of December 31, 2014) corresponding

to reserve requirements that financial entities incorporated in Peru shall maintain for

deposits and obligations to third parties. These funds are deposited in the vault of COFIDE

or the BCRP. Required reserve funds representing legal minimum do not generate

interests. Required reserve funds of the additional required reserve shall be paid at an

interest rate established by the BCRP. According to current legal provisions, required

reserve funds cannot be seized.

As of December 31, 2015, in BCRP, balances include (in thousands) US$17,500

(US$35,800 and S/.42,500 as of December 31, 2014) for overnight deposits held in BCRP,

which accrue interests at an annual effective rate of 0.2969% in foreign currency

(0.1279% in foreign currency and 2.30% in local currency as of December 31, 2014).

Overnight deposits accrued interests in 2015 for (in thousands) US$29 and (in thousands)

S/.73 ((in thousands) US$12 and S/.87 in 2014), which are included in item “Interest

income from cash” in the statement of income.

(b)

This item corresponds to provisions for country risk derived from term deposits held by

COFIDE in foreign banks (which are subject to regulatory provision for country risk).

Such deposits are held at the short term and the requirements for these provisions are

expected to decrease gradually. These provisions are established in accordance with the

SBS and internal policies of COFIDE about this matter.