- 23 -

6.

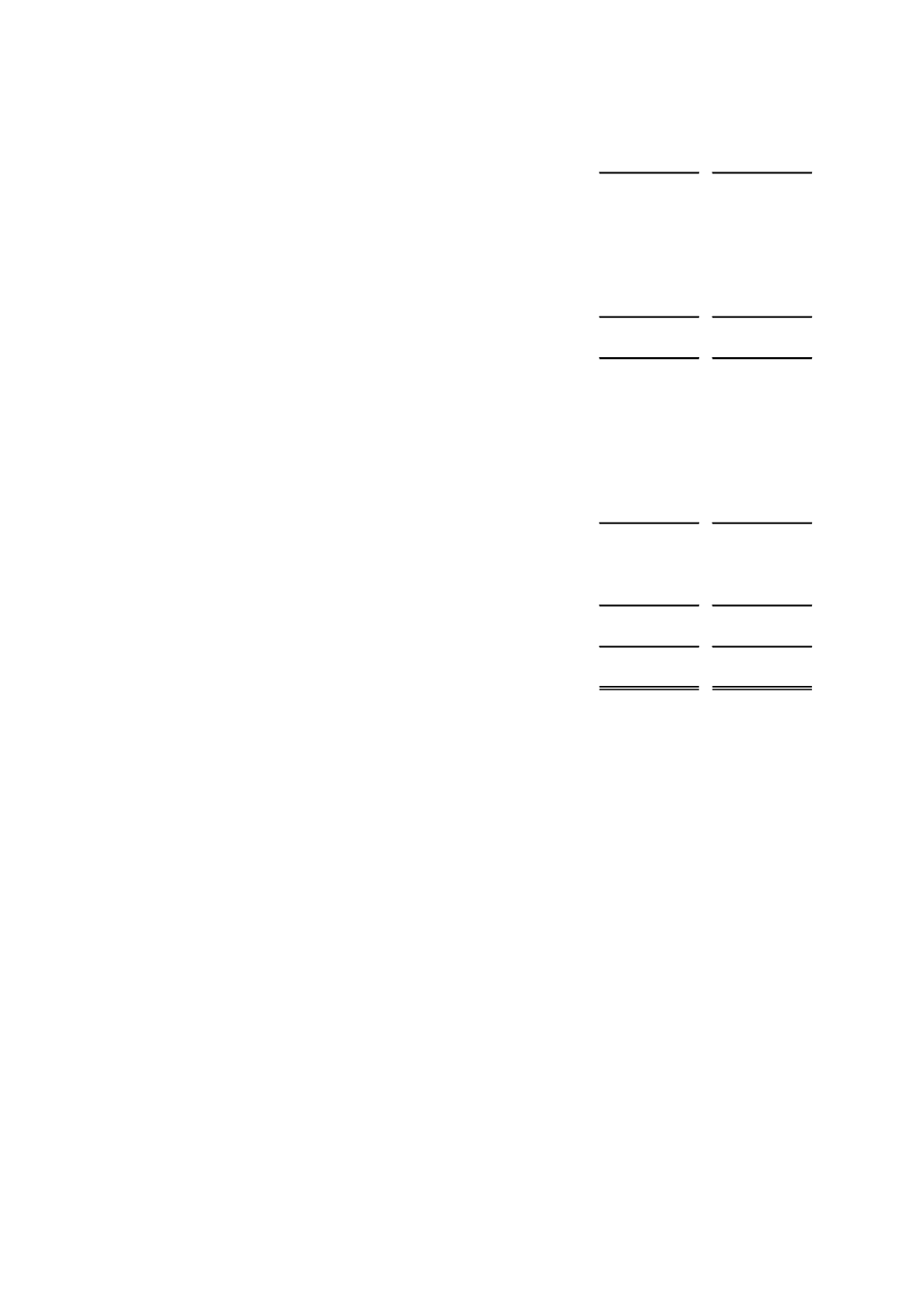

AVAILABLE FOR SALE INVESTMENTS

2015

2014

S/.000

S/.000

CAF shares (Note 3 (f.2))

2,339,156

2,339,156

Mutual funds

203,811

314,981

Investment funds

48,372

20,266

Shares

2,520

2,561

Impairment of investments - Investment funds

(6,924)

-

Equity instruments

2,586,935

2,676,964

Structured bonds

1,159,113

823,548

Corporate bonds

257,307

262,877

Securitization bonds

58,798

45,786

Commercial papers

33,305

2,966

Structured bonds / repos

23,764

29,805

Subordinated bonds

2,584

2,377

Sovereign bonds

-

18,581

1,534,871

1,185,940

Accrued interest

21,061

27,329

Debt instruments

1,555,932

1,213,269

Total

4,142,867

3,890,233

Investment in CAF was a contribution of the Peruvian Government between 1989 and 2000, as

class “B” shares of the CAF. Class “B” shares have a nominal value of US$5,000 each and

entitle the owner to designate a representative in the Board of Directors. As of December 31,

2015 and 2014, COFIDE holds 97,951 class “B” shares representing 11.50% and 12.43% equity

share in CAF, respectively.

Within the framework of IFRS harmonization and considering that CAF shares do not pay

dividends in cash, do not have a public active market, that it is not likely to determine an estimated

fair value of the investment and considering Official Letter No. 45853-2012-SBS, issued by the

SBS, which establishes the treatment of investments based on IFRS, since January 1, 2013,

COFIDE decided to record this investment under “Available for sale investments”, considering the

equivalent of the last value recorded by COFIDE as cost value, which was reported by COFIDE to

the SBS as of December 31, 2012 (Note 3 (f.2)).

Interest income of available for sale investments is recorded under “Interest income of available

for sale investments” of the statement of income.

As of December 31, 2015 and 2014, structured bonds / repos comprise bonds from Terminales

Portuarios Paita, which were granted as guarantee of short-term financing provided by trusts

managed by COFIDE (Note 10 (c)).

Management reviewed the carrying amount of its investments and recognized an impairment

loss of investments of Fondo de Inversión Latam Perú for (in thousands) US$2,030 as of

December 31, 2015; notwithstanding the foregoing, after the determination of impairment of

investments according to Resolution SBS No. 7033-2012, Management did not identify any