- 32 -

9.

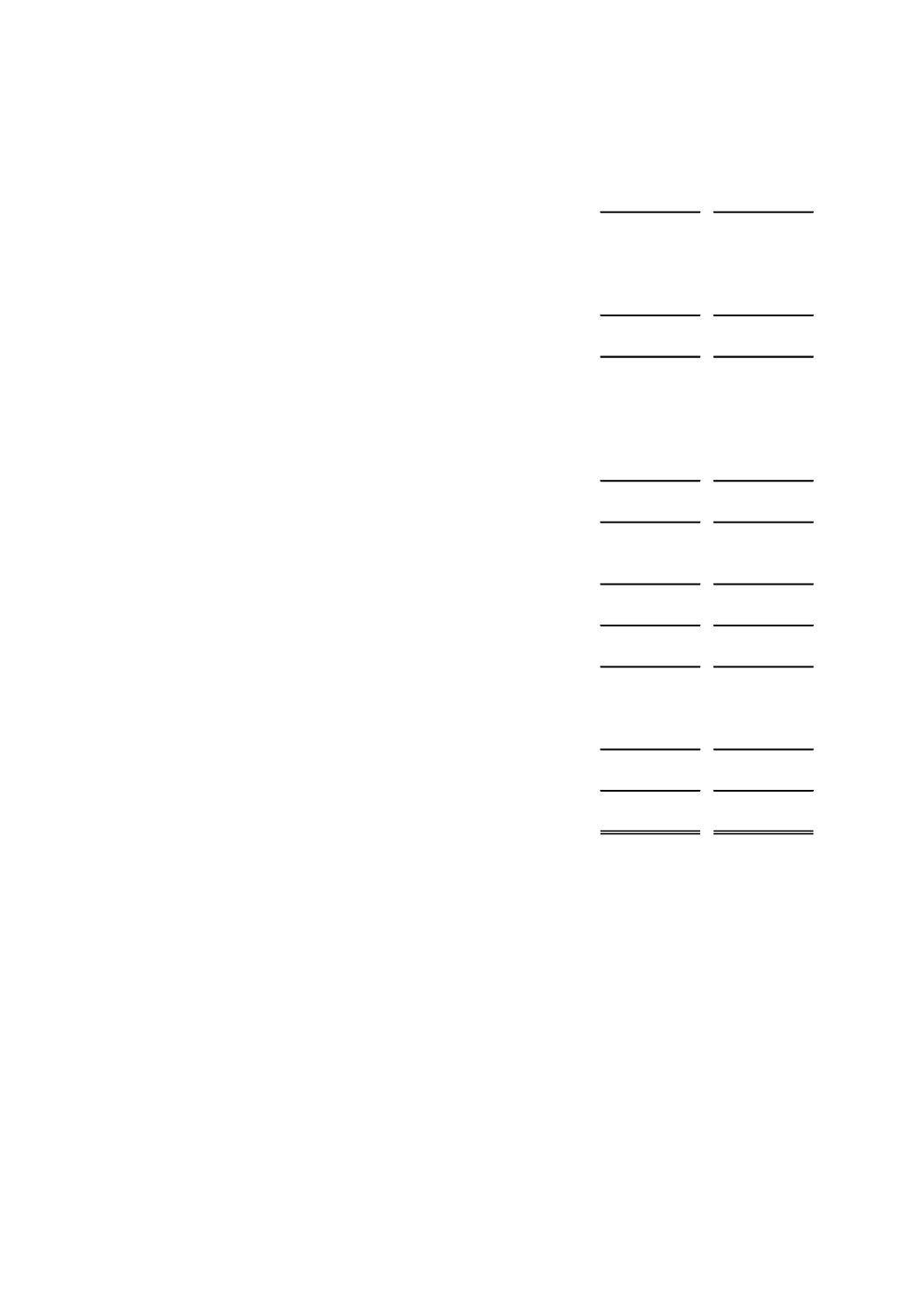

HEDGING DERIVATIVES, ACCOUNTS RECEIVABLE, NET, ASSETS SEIZED,

RECEIVED IN PAYMENT, AWARDED, INTANGIBLE ASSETS AND OTHER

ASSETS

2015

2014

S/.000

S/.000

Fair value - hedging derivatives - rate swaps (Note 12(a))

3,816

-

Fair value - hedging derivatives - currency swaps

-

139

Provisions for country risk - derivatives

(159)

(139)

Hedging derivatives

3,657

-

Restricted funds / Funds in guarantee - margin call (a)

58,260

49,538

Sundry accounts receivable

12,374

9,610

Accounts receivable for assigned loan portfolio

2,091

1,923

Commissions receivable

4,881

1,800

Provisions for accounts receivable and others (b)

(4,171)

(6,462)

Accounts receivable, net

73,435

56,409

Software

14,993

14,398

Software accumulated amortization

(8,740)

(7,079)

Intangible asset, net (c)

6,253

7,319

Assets seized, received in payment and awarded, net (d)

13,032

78

Commissions and other paid in advance

3,545

1,765

Works of art and library

779

765

Sundry items

1,264

1,392

Other assets

5,588

3,922

Total

101,965

67,728

(a)

As of December 31, 2015, COFIDE has funds in guarantee for (in thousands) US$17,080

(US$16,590 as of December 31, 2014) in favor of J. Aron & Company in both periods for

“Margin Call” in order to guarantee operations with interest-rate and currency derivatives

held by COFIDE.

According to the analysis of the restricted fund associated to “Margin Call”, result of the

constitution of a derivative financial instrument, Management considers reasonable to

record it as other assets and not as restricted cash.