- 49 -

17.

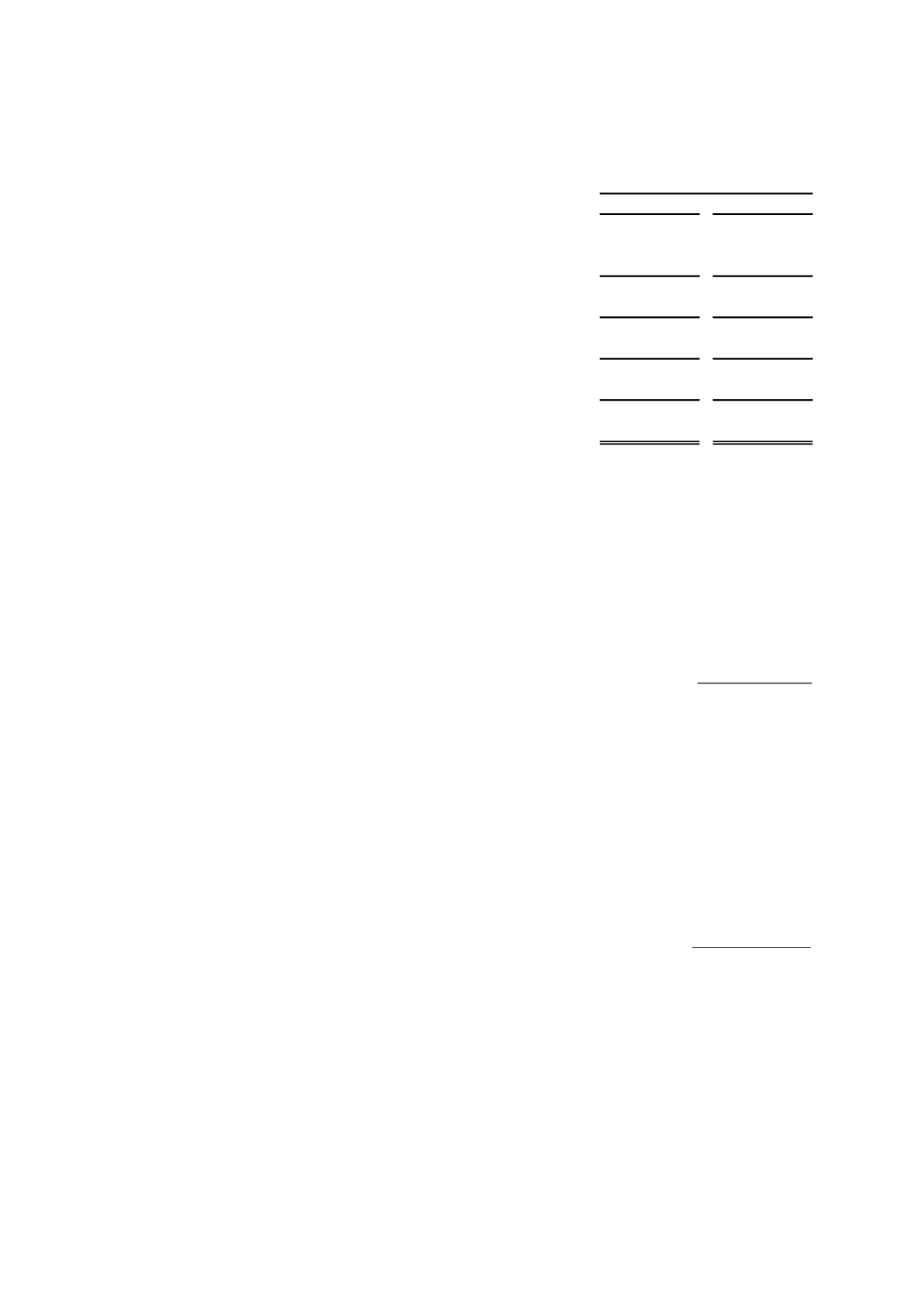

BASIC AND DILUTED EARNINGS PER SHARE

2015

2014

Outstanding at the beginning of the year

1,548,419

1,514,402

Capital increase (May 28, 2014)

-

14,157

Outstanding at the end of the year

1,548,419

1,528,559

Net profit for the year (in thousands) S/.

82,341

77,105

Shares

1,548,419

1,528,559

Earnings per basic and diluted share (S/.)

0.0532

0.0504

Number of shares

in thousands

18.

INCOME TAX

(a)

Income tax regime

Tax rates

Pursuant to Law No. 30296 – Law that promotes Economy Reactivation, the tax on third

category income recipients domiciled in Peru was modified, as presented below:

Taxable periods

Rate

2014

30%

2015-2016

28%

2017-2018

27%

2019 and subsequent periods

26%

Legal entities domiciled in Peru are subject to an additional rate, as shown below, on any

amount that may be considered as indirect income, including amounts charged to expenses and

unreported income; that is, expenses which may have benefited shareholders, parties, among

others; other expenses not related to the business; expenses of shareholders, parties, among

others, which are assumed by the legal entity.

Taxable periods

Rate

2014

4.1%

2015-2016

6.8%

2017-2018

8.0%

2019 and subsequent periods

9.3%

(b)

Significant amendments to income tax

After December 31, 2015, no changes have been made to the income tax regime in Peru which

may impact these financial statements. The standards and interpretations effective as of

December 31, 2015 have been considered by Management when preparing these financial

statements.