- 46 -

14.

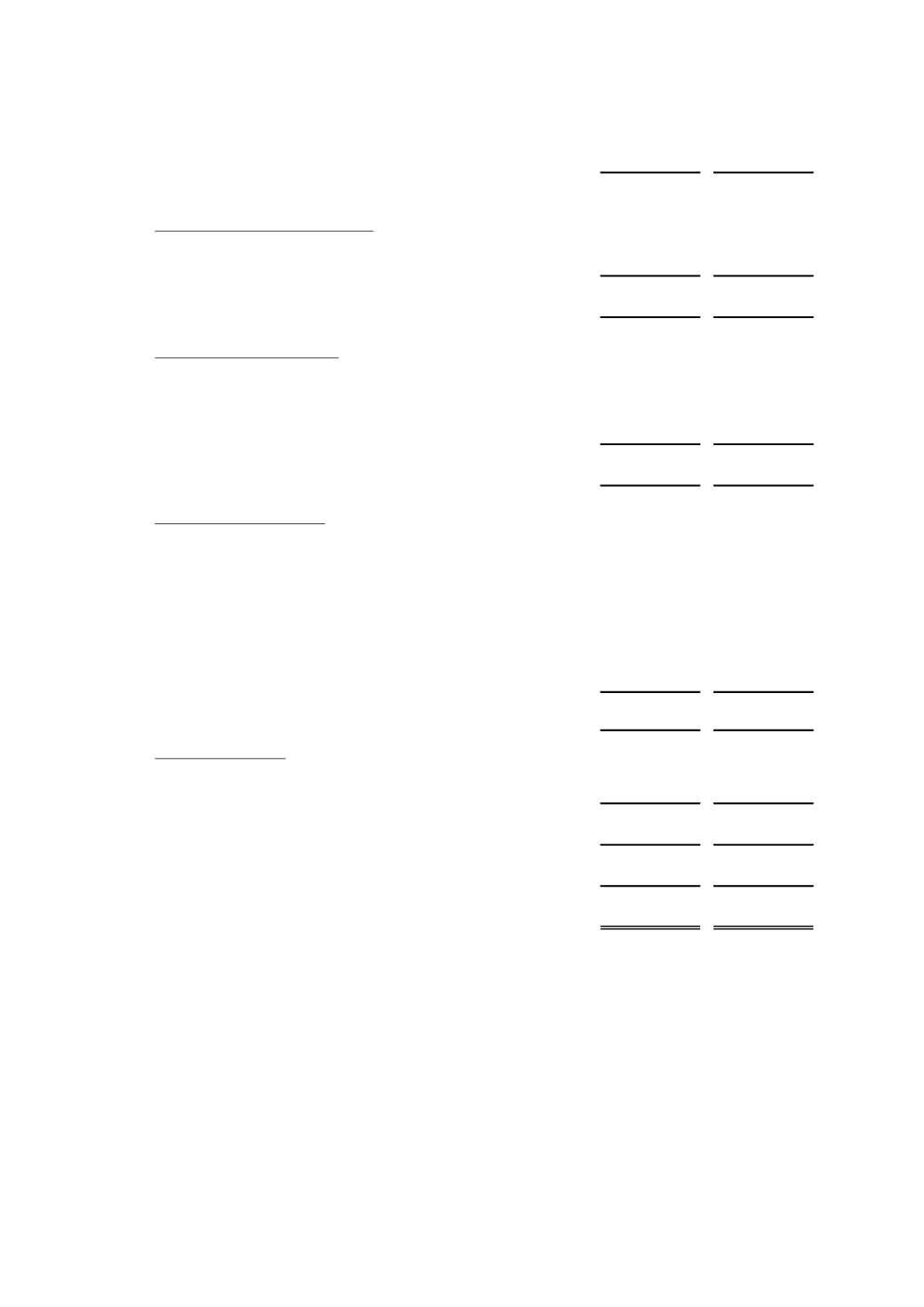

CONTINGENT AND OFF-BALANCE SHEET ACCOUNTS

2015

2014

S/.000

S/.000

Contingent risks and commitments (a)

Joint signatures granted (Note 7)

773,390

658,468

Other contingent accounts

15,407

20,890

Total

788,797

679,358

Trusts and trust commissions (b)

Guarantees for operations of credits of trusts

9,336,229

8,545,570

Counter-accounts of trusts and trust commissions

9,308,867

7,902,032

Trust funds

9,212,791

7,899,409

Funds in trust commissions

604,665

522,764

Total

28,462,552

24,869,775

Off-balance sheet accounts

Guarantees for loan transactions (c):

Promissory notes

5,320,225

4,897,227

Mortgages

42,574

211,345

Guarantee deposits

10,867

18,151

Documentary guarantees

19,070

12,549

Warrants

123

108

Other guarantees

143,523

130,643

Other off-balance sheet accounts

12,049,170

8,552,481

Total

17,585,552

13,822,504

Swaps and Forwards (d)

Swap and forward transactions

384,896

596,043

Nominal value - Interest-rate swap

682,200

40,311

Total

1,067,096

636,354

Total off-balance sheet accounts

47,115,200

39,328,633

Total contingent and off-balance sheet accounts

47,903,997

40,007,991

(a)

Contingent loans

In the normal course of business, COFIDE invests in off-balance transactions. These

transactions expose COFIDE to credit risk, in addition to the amounts presented in the statement

of financial position.

Credit risk in contingent operations is related to the likelihood that one of the investors of the

pertinent contract does not honor the terms established therein. The corresponding contracts

consider the amounts that COFIDE would assume for credit losses in contingent operations.

COFIDE uses similar policies to evaluate and grant credits, for direct credits as well as

contingent credits. In Management’s opinion, contingent transactions do not represent an

exceptional credit risk, since it is expected that a portion of these contingent credits will expire